Understanding Payment Aggregators

Newsletter #8 What are they and why are companies making a beeline for obtaining a PA license

In the first four months of 2024 alone, more than 20 companies (including tech startups) have received their Payment Aggregator (PA) license from RBI. These include Amazon Pay, Groww, MSwipe, Tata Pay, Zoho, Zomato, etc.. Currently, over 28 companies have received an in-principal approval from the RBI to operate as a Payment Aggregator.

Source: Inc42

What is a payment aggregator?

The RBI defines payment aggregators as entities which facilitate e-commerce sites and merchants to accept various payment instruments from customers for the completion of their payment obligations without the need for merchants to create a separate payment integration system of their own.

They enable merchants to connect with acquirers. These companies act as intermediaries between the merchant and the customer. They are able to receive payments from customers, pool them, and transfer them onto the merchants after a time period, according to the regulator.

To enable various payment methods on their own, businesses would have to partner with various banks and non-banking financial companies (NBFCs). In spite of having 34 nationalized banks and more than 9,500+ NBFCs, not every business has the ability to partner with such a large number of institutions, thus, payment aggregators essentially act as a middleman between individual businesses and financial institutions.

Another benefit of relying on payment aggregators is that you do not need to undertake the technological burden of designing and building a checkout page that meshes well with the various payment methods.

According to an article by Inc42, The Payment aggregator market is expected to grow from $3 trillion to $10 trillion by 2026 and this is driven mainly by large transactions.

How did it all start?

Earlier payment gateway companies were working in partnership with banks and were not regulated. Since digital payments have been growing exponentially over the last decade, RBI decided that it was time to bring these entities handling large sums of customer money under its direct regulation

By licensing these firms and bringing them under its direct control, the RBI can oversee any suspected money laundering activities and high-value suspicious transactions. It gives the RBI direct access to details on such transactions.

The RBI and Enforcement Directorate have also had issues with payment gateway firms facilitating crypto and betting transactions. The regulator also had issues with several payment gateway companies that were not diligent with the KYC of merchants. While Payment Gateways worked with banks, the final responsibility was with the banks, which often said that they don't have the capacity to check the KYC of merchants done by Payment Gateways. Now with the PA license, the responsibility falls clearly on the PA firms.

How will a PA License help?

Any payment firm or company handling and movement of large volumes of money will have to pay the payment gateway firms payment processing charges. Payment gateways or processing firms charge somewhere between 0.5 percent to 2 percent depending on the volume. Having a PA license helps these firms to save a few hundred crore to a thousand crore every year, which more than compensates for the expenses that these companies incur to run and maintain a PA license besides the compliance and data security adherence cost.

For instance, Zomato does a gross order value of Rs 13,000 crore in a quarter. Even a 0.5 percent commission to a PA firm would be Rs 65 crore in a quarter and Rs 260 crore in a financial year at the current turnover. Similarly, Amazon and Flipkart or even payment firms like PhonePe and Google Pay process several thousands of crores every year. So, it makes sense to have an in-house payment processing division than outsource it.

According to the RBI, both payment aggregators and gateways facilitate online payments, but only payment aggregators handle funds. Supported payment gateway aggregators make money by charging monthly fees, as well as fees for services like instant settlement.

Most payment aggregators either charge a nominal fee or, in some cases, no fees at all to create a sub-merchant account. Fees are charged when merchants accept payments online. Fees may also differ depending on the nature of the transaction. So for example, transactions with payment details keyed in may be charged differently to a card-swipe transaction or contactless payments.

How does it work?

Payment aggregators offer several benefits, addressing critical aspects like the secure processing of payment data and fraud detection and prevention. Payment aggregators also enable end-users to access multiple payment methods and enjoy a seamless checkout experience.

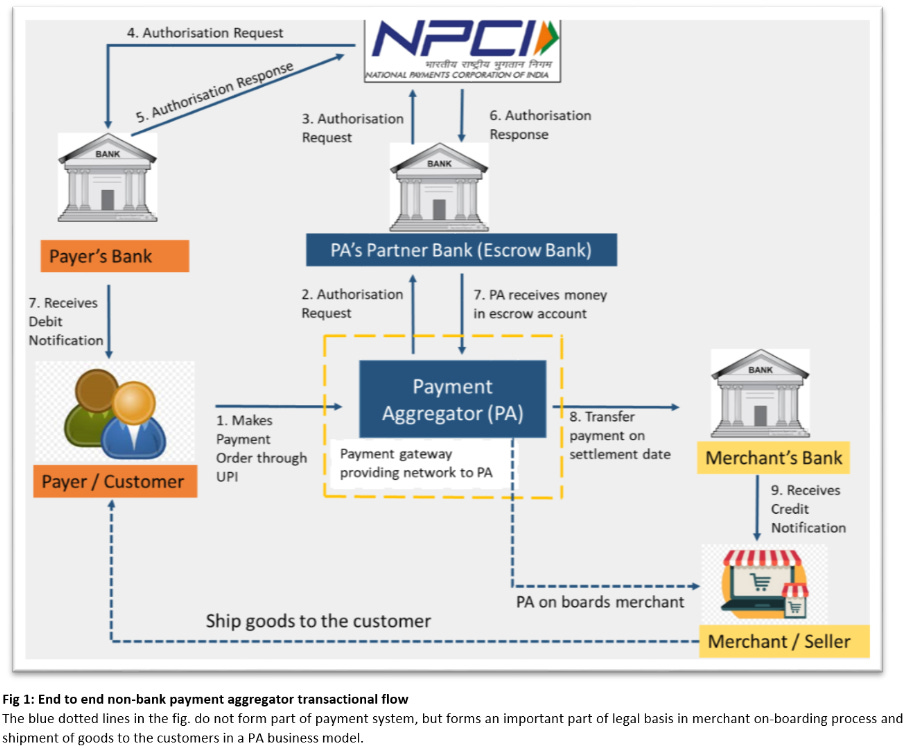

When a customer initiates a payment, the payment aggregator securely collects the payment details and routes them to the appropriate payment processor or acquiring bank The processor then authorizes and processes the transaction, transferring the funds from the customer’s account to the merchant account.

Payment aggregators also manage the settlement process, ensuring that funds from processed transactions are promptly transferred from the acquiring bank to the business bank account. While settlement periods may vary, businesses typically receive their funds within a few working days.

Source: https://vinodkothari.com/2021/04/understanding-regulatory-intricacies-of-payment-aggregator-business/

What is the requirement to become a PA firm?

A firm applying for a PA license should have had a net worth of Rs 15 crore at the end of March 31, 2021 and Rs 25 crore at the end of March 31, 2023

Difference between Payment Aggregator and Payment Gateway

A payment aggregator is a payment solution or a platform provider that aggregates various payment modes such cards, UPI, net-banking, wallets and alternate credit products by partnering with various processing entities such as acquiring banks, direct banks (in case of net banking) and issuers of wallets and alt credit products on to a single platform. A merchant can integrate with a payment aggregator and enable various payment options for its customers to make the payment.

In simple terms, a payment aggregator provides a stack of multiple payment methods to the merchants so that their customers can pay using their preferred mode of payment. Also, a payment aggregator does fund settlement, i.e. it moves the money from banks and other issuing entities to the merchants.

A payment gateway is a subset of a payment aggregator. A payment gateway securely transfers customer payment data from a website or an app to the payment processor. In contrast, a payment aggregator simplifies the payment process by consolidating multiple merchant accounts into a single account, making it easier for businesses to accept payments without individual setups.

Overall, a payment gateway is a technology used to perform online transactions, whereas a payment aggregator is a service provider with a collection of payment options.

So a merchant/business who wants to collect payments would need to partner with -

Acquiring bank directly (to process certain payment modes) and/or

Payment aggregators (who can bring various payment modes on a single integration)

A merchant cannot partner with Payment Gateways directly.

Sources:

https://khatabook.com/blog/payment-aggregator/

Decoding India’s Payment Aggregation Landscape – Inc42

https://www.business-standard.com/companies/news/rbi-grants-20-companies-with-pa-licence-in-the-first-four-months-of-2024-124043000891_1.html

https://stripe.com/in/resources/more/payment-aggregators-101

https://juspay.in/blog/payments/understanding-payment-gateway-vs-payment-aggregator#:~:text=A%20payment%20gateway%20securely%20transfers,accept%20payments%20without%20individual%20setups.